DoorDash Rewards Mastercard review: Doesn’t quite deliver

Editor's Note

DoorDash Rewards Mastercard overview

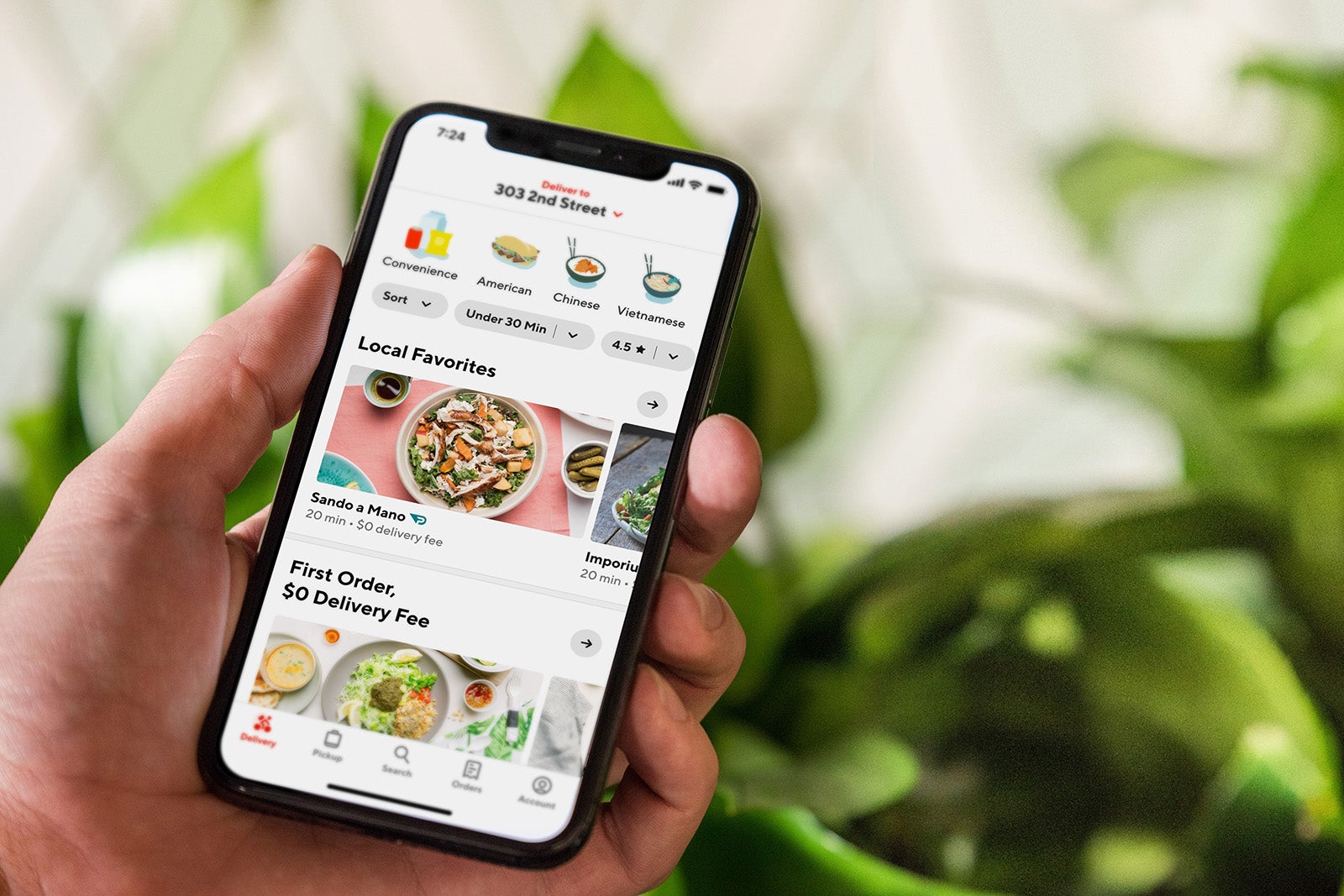

The DoorDash Rewards Mastercard® is a decent cash-back option for those who love ordering in, earning 4% back on DoorDash and Caviar orders and 3% back on online or in-store restaurant purchases. It's in the running for those who prefer to earn cash-back rewards on their dining purchases, but it's not the best option for earning or redeeming rewards. Card rating*: ⭐⭐

*Card rating is based on the opinion of TPG's editors and is not influenced by the card issuer.

Dining delivery has been around for over a decade, but it didn't become a regular part of many of our lives until 2020. It remains a modern luxury, and as such, Chase launched the DoorDash Rewards Mastercard in March 2023.

TPG recommends that those interested in applying for the DoorDash Rewards Mastercard® — which does not charge an annual fee — have a credit score of around 670.

If you're deciding whether this card might be a good fit for you, here's everything you need to know.

The information for the DoorDash Rewards card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

DoorDash Rewards Mastercard pros and cons

| Pros | Cons |

|---|---|

|

|

DoorDash Rewards Mastercard welcome offer

The current, standard welcome offer on the DoorDash card is an interesting one.

With it, you'll receive a free year of DashPass (a $96 value) for you and one authorized user, giving you both benefits like unlimited $0 delivery fees, 5% DoorDash credits back on pickup orders and member-only offers.

If you can maximize the value of your DashPass membership, this offer value is comparable to what we expect from most cash-back cards without an annual fee.

Related: How to choose a cash-back credit card

DoorDash Rewards benefits

As a cardholder, you'll get special offers and benefits, including 10% off one convenience, grocery, alcohol, retail or DashMart order every month (maximum discount of $15 each month; ends Dec. 31).

You'll also get perks like trip cancellation insurance, purchase protection and extended warranty protection.

In addition to the benefits unique to this card, you'll receive World Elite Mastercard benefits such as access to Mastercard World Elite Concierge and a monthly $5 Lyft credit after taking three rides in one calendar month.

Related: Best no-annual-fee cash-back credit cards

Earning cash back on the DoorDash Rewards Mastercard

On top of earning bonus rewards on your DoorDash purchases, this card rewards you for all your dining and grocery spending. You'll earn:

- 4% cash back on DoorDash and Caviar orders through the DoorDash platform

- 3% cash back on online or in-store restaurant purchases

- 2% cash back on online or in-store grocery purchases

- 1% cash back on all other purchases

While these aren't necessarily bad earning rates, they aren't special. Several of our favorite cash-back and dining cards have earning rates similar to or better than what you'll get with the DoorDash card.

Related: Best credit cards for everyday spending

Redeeming cash back on the DoorDash Rewards Mastercard

Once you've racked up some rewards, you can be like former TPG writer Ryan Wilcox and use them to pay for part or all of a DoorDash or Caviar order.

You can also redeem them for gift cards or opt for the traditional route and get cash back — either as a statement credit or direct deposit into your bank account.

Which cards compete with the DoorDash Rewards Mastercard?

The DoorDash Rewards Mastercard is far from the only card that earns bonus rewards on food purchases. You may want to consider a different card if you spend much of your budget on anything other than DoorDash:

- If you want to earn travel rewards on your dining purchases: The American Express® Gold Card earns 4 points per dollar spent at restaurants (on up to $50,000 in purchases per calendar year, then 1 point per dollar) and U.S. supermarkets (on up to $25,000 in purchases each year, then 1 point per dollar spent). For more details, check out our full review of the Amex Gold.

- If you want to earn cash back on your dining and entertainment purchases: The Capital One Savor Cash Rewards Credit Card has no annual fee (see rates and fees) and allows you to earn more on your everyday spending with a wider range of bonus categories. For more details, check out our full review of the Savor Cash Rewards card.

- If you want to earn more cash back on all your purchases: The Chase Freedom Unlimited® earns the same as the DoorDash card on dining (3% cash back), plus 1.5% on all other purchases, so you may earn more cash back overall with this card. For more details, check out our full review of the Freedom Unlimited.

For additional options, check out our full list of best cash-back credit cards and best credit cards for dining.

Read more: Who should (and shouldn't) get the Amex Gold?

Is the DoorDash Rewards Mastercard worth it?

If you order through DoorDash or Caviar frequently and prefer the simplicity of earning cash-back rewards, you may enjoy having this card. However, its earning structure isn't remarkable. Even if the DoorDash perks appeal to you, remember that some other Chase cards offer a complimentary DashPass membership and earn 3 points per dollar spent on DoorDash purchases.

Related: What the Chase and DoorDash partnership means for you

Bottom line

If you order delivery often, you'll appreciate the DoorDash perks and bonus-earning that you'll get with the DoorDash Rewards Mastercard. You may also value redeeming your rewards for future DoorDash orders.

But before you dash to get this card, look at our other favorite dining rewards cards to ensure your rewards are as good as your favorite takeout.